Understanding a Health Savings Account

Posted by Anna Koehler on Dec 3, 2014 in Health Insurance News

What is a health savings account?

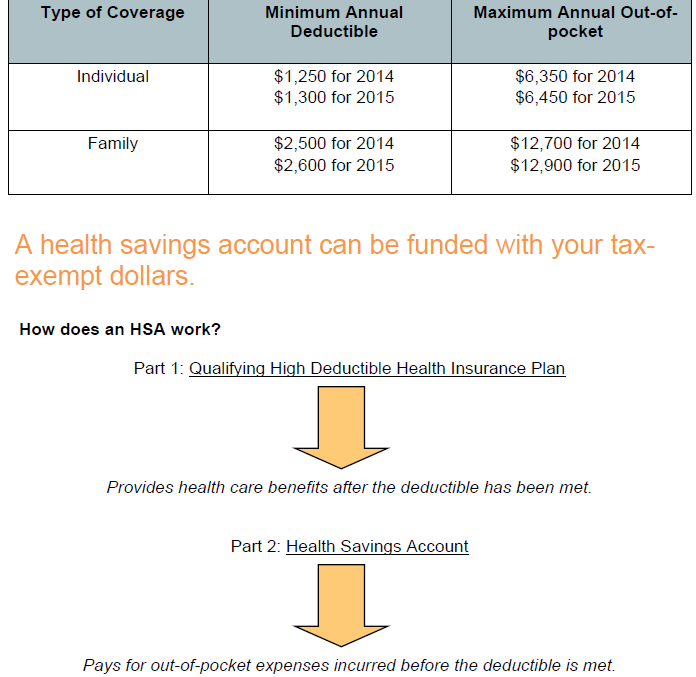

Otherwise known as an HSA, a health savings account can be funded with your taxexempt dollars. Dollars from the account can help pay for eligible medical expenses not covered by an insurance plan, including the deductible, coinsurance and even health insurance premiums in some cases.

Who is eligible for an HSA?

Anyone who is:

- Covered by a high deductible health plan (HDHP);

- Not covered under another medical plan that is not an HDHP;

- Not entitled to (eligible for AND enrolled in) Medicare benefits; or

- Not eligible to be claimed on another person’s tax return.

What is a high deductible health plan (HDHP)?

A high deductible health plan is a plan with a minimum annual deductible and a maximum out-of-pocket limit as listed below. These minimums and maximums are determined annually by the Internal Revenue Service (IRS) and are subject to change.

What are the steps in an HSA?

1. HSA account holder or eligible family member and/or someone else funds the individual HSA account.

2. Individual seeks medical services.

3. Medical services are paid by HDHP, subject to deductible and coinsurance.

4. Individual may seek reimbursement from HSA account for amounts paid toward deductible and coinsurance.

5. Deductible and out-of-pocket maximum fulfilled.

6. Individual may be covered for all remaining eligible expenses.*

The HDHP can provide preventive care benefits without the required minimum

*Subject to plan design; check your HDHP Summary Plan Description.

When do I use my HSA?

After visiting a physician, facility or pharmacy, your medical claim will be submitted to your HDHP for payment. Your HSA dollars can be used to pay your out-of-pocket expenses (deductibles and coinsurance) billed by the physician, facility or pharmacy, or you can choose to save your HSA dollars for a future medical expense. You may also be able to use an HSA debit card to access your HSA funds, if your HAS custodian or trustee allows it. You may use your HSA for non-medical expenses. However, HAS amounts that are used for non-medical expenses are taxable as income to you and are generally subject to an additional 20 percent penalty.

What is a deductible?

It is a set dollar amount determined by your plan that you must pay out-of-pocket or from your HSA account before insurance coverage for medical expenses can begin.

How much can I contribute to an HSA?

The annual HSA contribution limits for 2014 are:

- $3,300 for individual coverage and $6,550 for family coverage

The annual HSA contribution limits for 2015 are:

- $3,350 for individual coverage and $6,650 for family coverage

Individuals age 55 or older may be eligible to make a catch-up contribution of $1,000.

What if I enroll in an HSA in the middle of the year?

Your HSA contributions are generally determined on a monthly basis. However, if you enroll in an HSA mid-year, you are allowed to make a full year’s contribution, provided you are eligible on Dec. 1 of that year and you remain eligible for HSA contributions for at least the 12-month period following that year.

Why should I elect an HSA?

1. Cost Savings

• Triple tax benefits

- HSA contributions are excluded from federal income tax

- Interest earnings are tax-deferred

- Withdrawals for eligible expenses are exempt from federal income tax

• Reduction in medical plan contribution

• Unused money is held in an interest-bearing savings or investment account

Note: Many states have not passed legislation to provide favorable state tax treatment for HSAs. Therefore, amounts contributed to HSAs and interest earned on HSA

accounts may be included for state income tax purposes.

2. Long-term Financial Benefits

• Save for future medical expenses.

• Funds roll over from year to year.

3. Choice

• You control and manage your health care expenses.

• You choose when to use your HSA dollars to pay your health care expenses.

• You choose when to save your HSA dollars and pay health care expenses out of pocket.

• You decide whether to use your HSA dollars to pay for non-medical expenses and incur the additional

For more information about health savings accounts, or for help getting started, contact Koehler, Koehler Inc. today.